Client Processing – Scope and Capabilities

May 6, 2025

Purpose

This document represents the next step in the Phase 2 planning process and bridges between the high-level scope approved by management and the detailed specifications needed for implementation. The primary audience is the Core Team, Engineering, and key stakeholders who will be directly involved in building and implementing the new system. Engineering will use this as the basis for determining the high-level architecture and estimating build effort. It will also guide our implementation planning.

Introduction

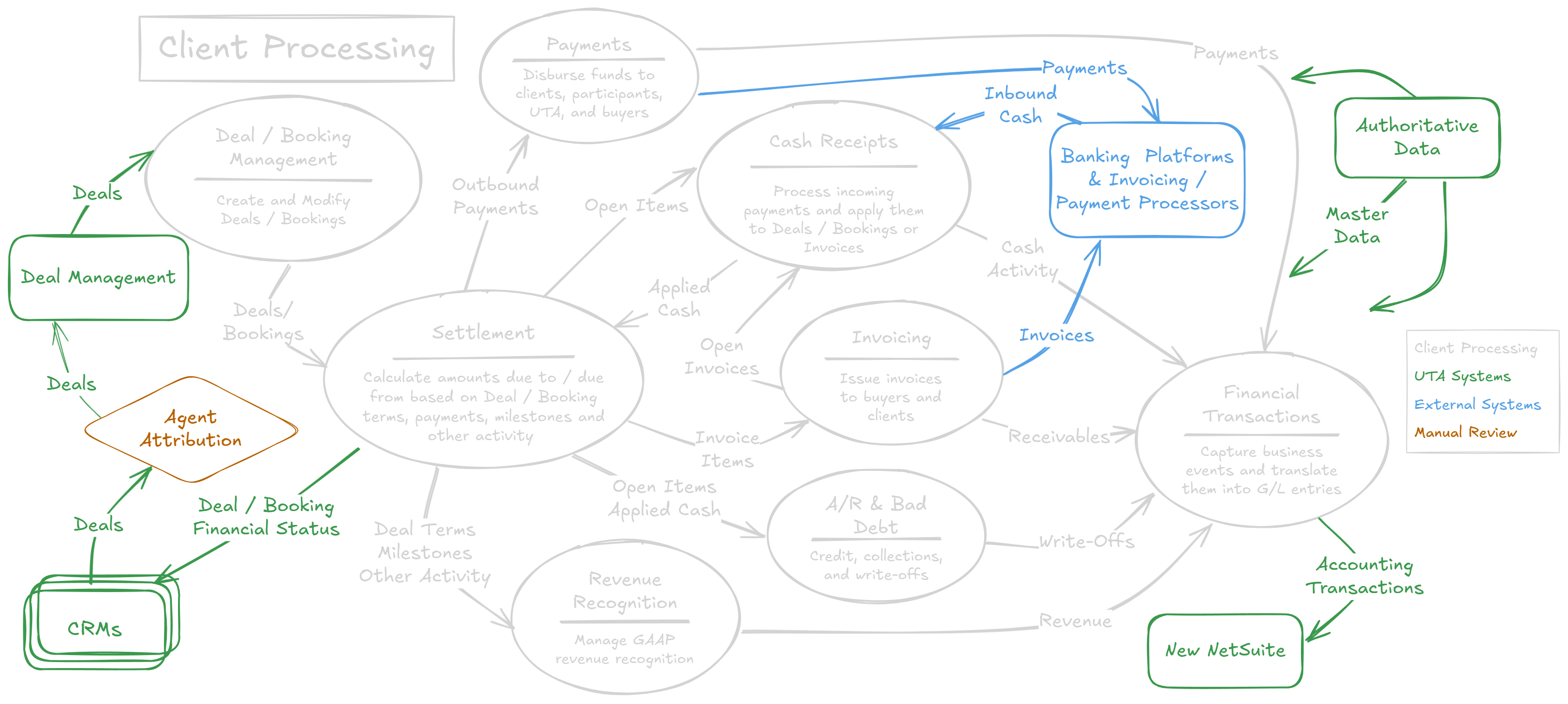

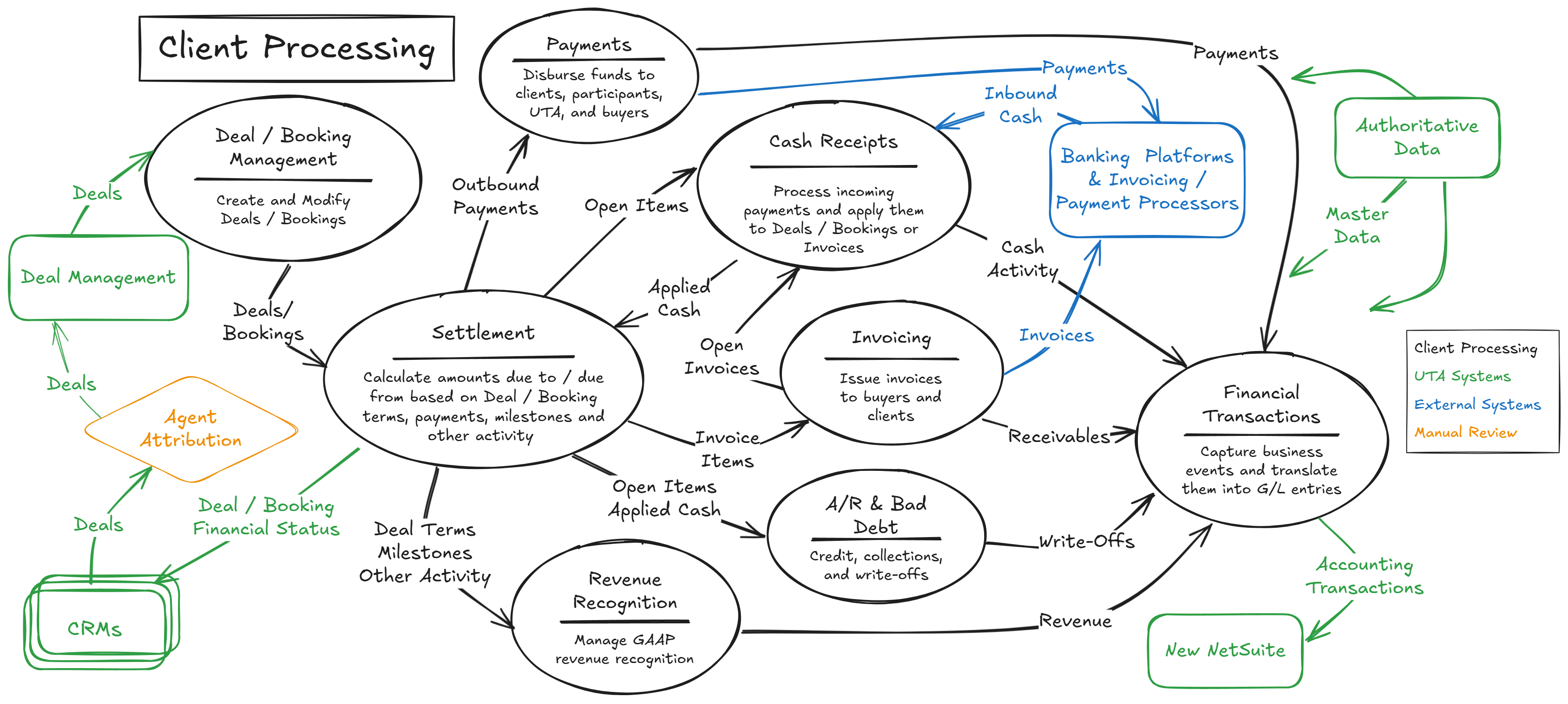

The UTA Client Processing System serves as the core financial platform that enables the agency's business operations. The system facilitates transaction flow between buyers, clients, and participants while providing the tools and capabilities needed for effective marketplace operation. Through integrated components handling different aspects of financial processing, the system supports UTA's ability to manage complex deal structures, process transactions efficiently, and maintain high service levels for all stakeholders.

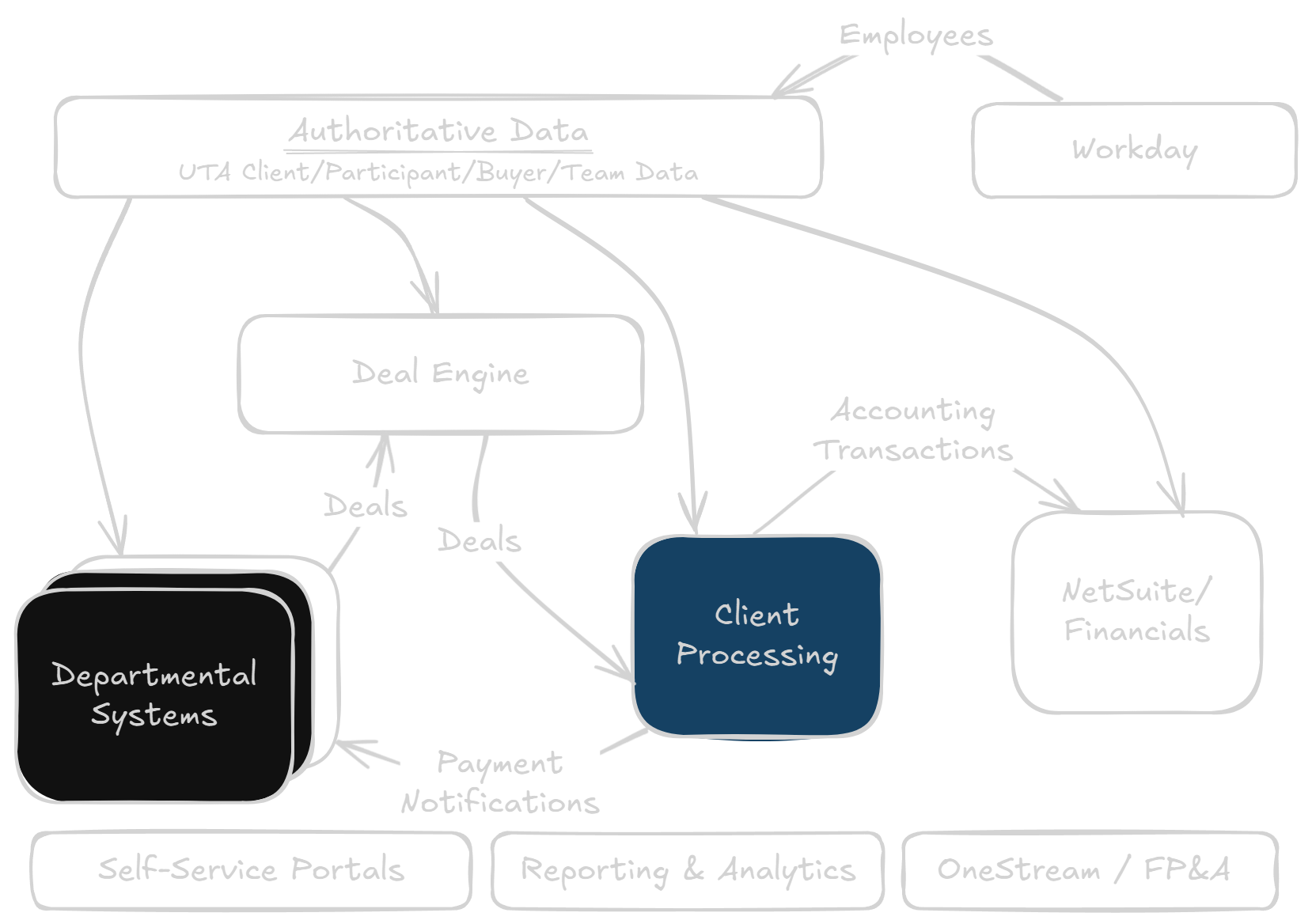

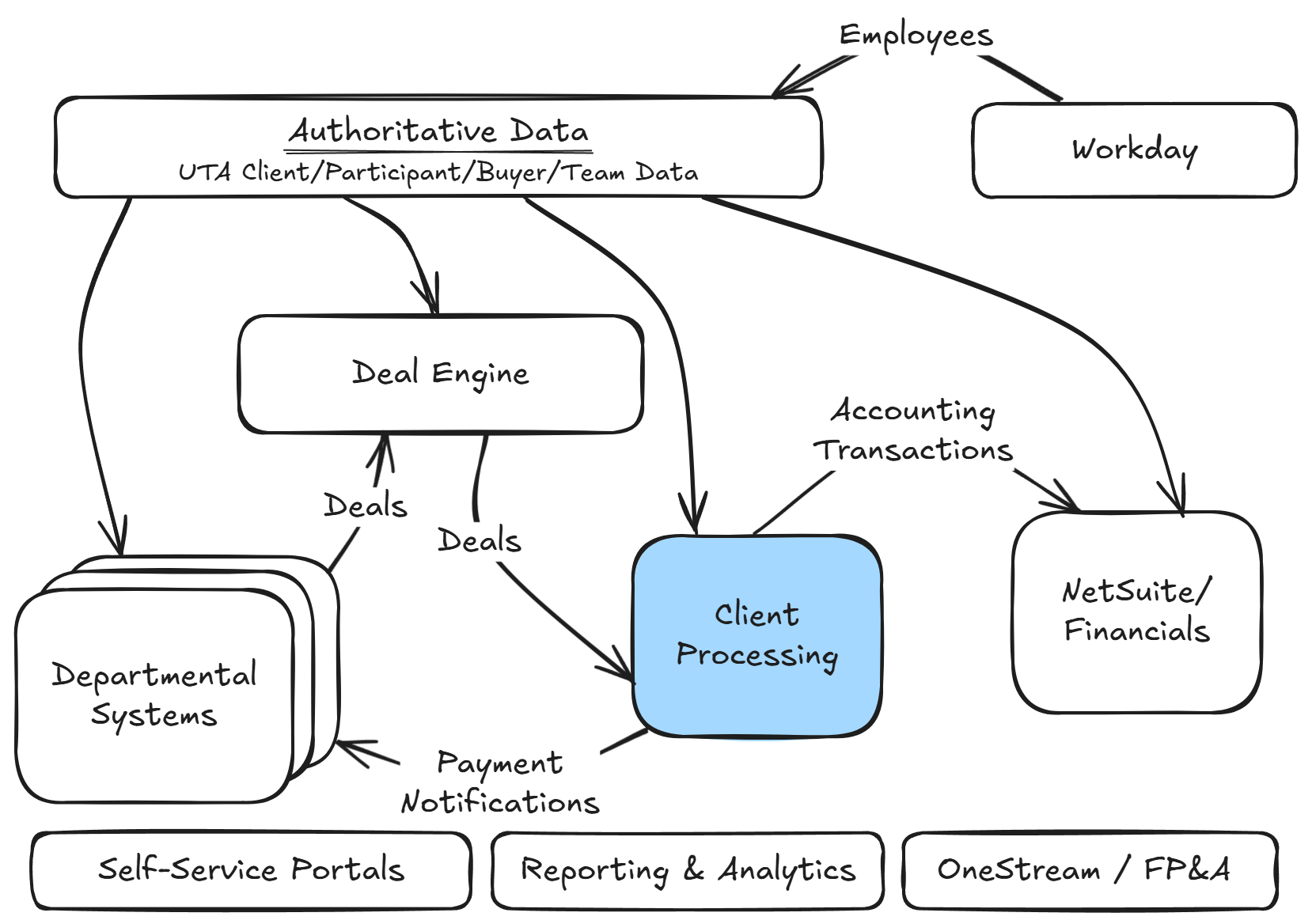

Client Processing fills a key component of the overall Client Framework ecosystem.

Client Processing scope and capabilities are organized into six functional areas:

- Booking Management – Handles deal financial lifecycle from approval through closure

- Settlement – Calculates amounts due to/from based on deal/booking terms, payments, milestones, and other activity

- Cash Receipts - Processes and matches all incoming payments

- Invoicing - Generates and manages both buyer and commission invoices

- Payments - Controls distribution of funds to clients and participants

- AR & Bad Debt - Tracks receivables, manages collections, and processes write-offs

- Revenue Recognition - Records and verifies revenue

- Financial Transactions – Captures business events and translates them into GL entries

These functional areas interact with each other to deliver the overall function of Client Processing.

Key metrics

The following metrics establish the scale and complexity of UTA's client processing operations, providing context for system requirements and design decisions.

- Daily payment processing: 400 transactions

- Daily transaction value: $5-8 million

- Annual bookings: 47,470 (2024)

- Annual cash received: $2.9 billion (2024)

- Unique participants: ~20,000

- Active clients: ~17,000

- Processing staff: 122 (including touring)

- In-flight funds: $33 million average

Booking Management

Overview

Booking management handles the lifecycle of deals within the system based on data from Deal Management. This function captures and maintains deal structures ranging from simple one-time payments to complex multi-party arrangements with contingent compensation. It provides capabilities for deal entry, modification tracking, status management, and milestone tracking. It supports various deal types across departments, manages participant relationships, tracks commission structures, and maintains the connection between original deal terms and resulting financial transactions.

Key Metrics

Booking Volumes

- Annual bookings: 47,470 (2024)

- Booking lines: 152,054 (2024)

- Average cash per booking: $61,746

- Package deals: 172 (2024)

- Cross-departmental bookings: [% of total]

Processing Performance

- Average booking entry time: [Current/Target]

- Booking modification rate: [% of bookings]

- Error rate in booking entry: [Current/Target]

- Package deal processing time: [Current/Target]

Key Functions in Scope

Deal Management Integration

Works in concert with Deal Management to handle complex deal structures and terms. This includes managing the relationship between standard bookings and package deals, tracking contingent compensation terms, and ensuring proper handling of multi-party transactions.

- Enables agents and assistants to enter deals with status indicators in departmental CRM or Deal Management systems. (See Open Items below)

- Provides automatic notification to accounting when deal status changes, particularly when confirmed

- Creates booking records in Client Processing based on information entered in Deal Management, including:

- Client and loanout information

- Guaranteed compensation with milestone schedules

- Contingent compensation details (overages, buyouts, bonuses)

- Commission rates and structures, allowing for different commission rates at line-item level

- Agent team information with allocation percentages

- Third-party participants and their commission rates

- Complete buyer information (name, address, contacts)

- Invoicing contacts and special instructions

- Supports attachment of contracts and statements to booking records for deal documentation

- Provides access to booking information for accounting representatives

Deal Lifecycle Management

Oversees a booking from creation through closure, including status tracking, modification handling, and milestone management. This function must support various deal types and structures while maintaining the integrity of the original deal terms and any subsequent modifications.

- Maintains booking status (Unapproved, Billed, Partially Paid, Closed, TBD) and booking line status (Verified, Unverified, Write-off, TBD)

- Provides structured note fields at the line-item level for AR notes, collection notes, and invoice notes

- Assigns and maintains department codes for each booking to support departmental reporting

- Maintains complete buyer/production contact information for payment follow-up

- Implements standardized confidentiality protocols for all deals

- Supports package tracking with hierarchical relationships between related bookings

- Enables project linking to maintain relationships between related deals

- Supports identifying and tracking backend components as separate deals linked to the original deal

- Facilitates role-based access control within the Client Processing system

- Maintains occupation code definitions for accounting representative reference

- Supports in-line calculations in all booking fields

Change Control and Version Management

Maintains a comprehensive history of all booking changes, including modifications to compensation, dates, and terms. This function ensures that all stakeholders have visibility into booking evolution while maintaining an audit trail of who made changes and why.

- Automatically routes all booking changes (compensation, contacts, dates, status) to Client Processing

- Creates notification queue items for accounting representatives to review booking changes

- Provides dynamic reporting to view and analyze changes to booking compensation and service dates

- Maintains an audit trail of who made changes and when

- Preserves change history for compliance and reference

Open Items

Clarity is required to define the boundary between Booking Management and Deal Management. Deal Management integrates across various CRMs and serves as the primary conduit from CRMs to Client Processing.

Key capabilities are included in Appendix A.

Settlement

Overview

The settlement function manages calculation of amounts due to and from various parties for a transaction. This function handles the business rules that determine how funds are allocated among clients, participants, and UTA. It provides capabilities for handling multi-party settlements, commission calculations, and special payment arrangements. The component ensures application of financial terms while supporting flexible settlement structures to accommodate the diverse nature of UTA's deals.

Key Metrics

Settlement Volumes

• Daily settlements processed: [Metric needed]

• Multi-party settlements: [% of total]

• Average settlement complexity: [Metric needed]

• Settlement recalculation rate: [% of settlements]

Settlement Performance

• Average calculation time: [Current/Target]

• Calculation accuracy rate: [Current/Target]

• Exception handling rate: [% of settlements]

Key Functions in Scope

Financial Terms Processing

Manages translation of deal terms into financial transactions, including setting up payment schedules, tracking milestones, and managing commission calculations. This function ensures that deal structures are properly reflected in the financial processing workflow.

- Auto-populates bookings in Client Processing with compensation and contract details from Deal Management when deals are confirmed

- Enables accounting representatives to review and set up receivable lines based on deal milestones and separately list non-commissionable items not factored into deal totals (e.g., meal penalty, relocation, etc.)

- Allows accounting to edit milestone descriptions for clarity and consistency

- Permits editing of service dates and compensation amounts (within guaranteed limits)

- Provides cross-departmental visibility of client AR to accounting representatives

- Derives payee splits from master client record to ensure consistency

- Supports agent allocation tracking (Booking Agent, Responsible Agent, Agent team)

- Handles deals booked in foreign currencies with exchange rate management

- Implements detailed tracking for profit participation deals including:

- Statement receipt and tracking

- Due date monitoring

- Email notifications for follow-up

- Estimates future period amounts at 90% of statement amount

Settlement Management

Oversees creation and processing of settlement statements, including pre-settlement review, approval workflow, and final distribution. This includes handling complex scenarios such as multi-booking settlements, commission withholding, and participant payments.

- Generates batch summary journals detailing all prepared settlements

- Includes original payment documentation with settlement batches

- Creates standard pre-settlement and final settlement statements

- Allows addition of explanatory notes to statements

- Handles commission rebates and reimbursements within settlement batches

- Processes direct commission payments against open AR items

- Manages various payment scenarios including advances, loans, and special arrangements such as manual wires and fold for future dates

- Supports pre-settlement for future-dated bookings and disbursement agreements

Open Items

Additional analysis is required to define the full breadth of Settlement functions.

Key capabilities are included in Appendix B.

Cash Receipts

Overview

The cash receipts function manages the intake and processing of all incoming payments to UTA. This function handles multiple payment methods including electronic transfers, checks, and credit cards across various currencies. It provides capabilities for payment matching, application to bookings, handling of split payments, and exception processing. The component maintains payment records, manages reconciliation processes, and ensures proper handling of payment-related documentation while supporting both automated and manual payment processing workflows.

Key Metrics

Payment Volumes

- Daily cash receipts: $5-8 million

- Annual cash received: $2.9 billion (2024)

- In-flight funds: $33 million average

- Unidentified payments: [% of total]

- Split payment frequency: [% of transactions]

Processing Efficiency

- Average matching time: [Current/Target]

- Auto-match success rate: [Current/Target]

- Exception handling time: [Current/Target]

- Payment application accuracy: 99.8% target

Key Functions in Scope

Cash Receipt Processing

Manages intake and initial processing of incoming cash, including electronic transfers, checks, and credit card payments. This function provides timely visibility to all incoming domestic and international cash receipts through multiple channels.

- Implements a queue system for all incoming electronic payments and physical checks

- Integrates with banking platforms to automatically pull payment information and remittance backup throughout the day

- Handles all accepted currencies for incoming wires to UTA

- Makes deposit queue visible within the Booking system to enable agent/assistant participation in payment identification

- Supports payment of direct commission through credit cards and other means

- Provides notifications to the Booking system when funds are applied to a booking record

- Allows cash application to a booking record without issuing an invoice

Cash Matching and Allocation

Facilitates accurate matching of incoming cash receipts to bookings and invoices, supporting both automated and manual matching processes. This includes split payments across multiple bookings and payment reallocation when necessary.

- Enables assignment of payments to specific clients, booking numbers, or invoices

- Leverages multiple methods match deposits:

- Payment data received by assistants and loaded into system for matching

- Automated ingestion of remittance information from buyers

- AI matching

- Matching queue available to client teams and finance to identify payments

- Distributes lists of incoming/unclaimed wires to agents/assistants for identification assistance

- Allows splitting of deposit funds across multiple clients or booking lines for complex payments

- Allows reassigning of funds across multiple clients and booking lines

- Provides robust search capabilities to find matching bookings

- Implements intelligent matching algorithms based on payment information

Exception Management

Identifies and manages exceptions in the payment process, including unidentified payments, overpayments, and incorrect payments. This function includes workflow for research, resolution, and handling of exceptional cases, ensuring that all funds are properly tracked and allocated.

- Includes notes fields for cash team and accounting representatives to document payment information

- Enables transfer of funds across clients/bookings when payment application errors are identified

- Provides functionality to flag incorrectly sent funds for return to sender

- Implements workflow for researching unidentified payments

- Tracks exception resolution status and time to resolution

- Maintains audit trail of all exception handling actions

Bank Integration and Reconciliation

Maintains connectivity with banking platforms, ensuring visibility of incoming funds and supporting automated reconciliation processes. This function manages multiple bank accounts, currencies, and payment methods while maintaining accurate financial records.

- Enables sorting of the deposit queue by multiple criteria (currency, date, amount, etc.)

- Preserves check images/payment documentation from lockbox, ACH, and wires throughout the payment lifecycle

- Provides accounting representatives with view-only access to bank account information

- Supports reconciliation processes between bank statements and the Client Processing system

- Handles multiple bank accounts and payment methods

Open Items

The exact process for integrating Cash Receipts in Client Processing with cash and bank account management in core financials (NetSuite) requires further discussion. The system must support Bank account reconciliation and other Treasury functions while also enabling rapid cash assignment within Client Processing.

Key capabilities are included in Appendix C.

Invoicing

Overview

The invoicing function handles generation and management of both buyer invoices (on behalf of clients) and direct commission invoices to clients. This system handles various invoicing scenarios, from automated milestone-based invoicing to manual request fulfillment, while supporting multiple currencies and tax jurisdictions. It manages invoice versioning and maintains integration with accounts receivable tracking. The system accommodates various invoicing requirements while ensuring consistent processing and documentation.

Key Metrics

Invoice Volumes

- Annual invoices generated: [Total needed]

- Buyer invoices: [% of total]

- Commission invoices: [% of total]

- Average invoice value: [Metric needed]

- Multi-currency invoices: [% of total]

Processing Performance

- Automated vs manual ratio: [Current/Target]

- Average generation time: [Current/Target]

- Invoice accuracy rate: [Current/Target]

Key Functions in Scope

Invoice Generation and Management

Handles creation and management of all invoice types, supporting both automated and manual generation processes. This function includes template management, multi-currency support, and handling of special invoicing requirements for different regions and deal types. It must support both buyer invoices for client earnings and direct commission invoices to clients.

- Supports invoice requests including client, booking number, milestones, amounts, and VAT

- Allows assistants to generate invoices directly from the Booking system that flow to Client Processing

- Enables accounting representatives to generate invoices directly from booking milestones

- Allows invoice creation from multiple access points within Client Processing for workflow efficiency

- Provides separate templates for buyer invoices (client earnings) and client invoices (commission)

- Supports invoicing buyer on behalf of a direct commission client

- Includes dynamic, editable invoicing templates to handle special requirements

- Automatically selects correct UTA bank/wire details based on booking currency

- Allows invoicing of single or multiple AR lines simultaneously across various bookings for the client

Workflow and Approval Processing

Manages flow of invoice requests and approvals, routing of requests as needed, and tracking of approval status. This includes handling special invoicing requirements, supporting communication between agents and accounting representatives, and maintaining proper documentation of all decisions.

- Creates dedicated accounting queue for invoice requests

- Provides separate queues for agent-originated invoice requests

- Facilitates threaded communication between accounting and requestors with tracking and archiving

- Implements approval workflows based on invoice type and amount

- Maintains documentation of all communications and decisions

Distribution and Tracking

Oversees the distribution of invoices to appropriate parties, tracking delivery and receipt confirmation. This function manages different distribution methods based on recipient preferences and requirements, while maintaining a history of all invoice-related communications and status changes.

- Automatically distributes invoices to contacts specified in the booking record

- Maintains invoice records at the line-item level (milestone) for perpetual access

- Includes accounting representative contact information on invoices for queries

- Provides capability to track days elapsed since invoicing

- Maintains a history of all invoice-related communications

Open Items

[None noted]

Key capabilities are included in Appendix D.

Payments

Overview

The client payments function manages distribution of funds to clients, participants, buyers, and UTA. This component handles payment generation, approval workflows, and disbursement processing. It provides capabilities for managing complex payment scenarios including multi-party payments, commission calculations, advances, and loans. The component supports various payment methods, handles tax withholding requirements, manages participant payment rules, and maintains comprehensive payment records and supporting documentation.

Key Metrics

Payment Volumes

- Annual outgoing payments: 272,926 (2024)

- Average payment size: $10,739

- Total participants: ~20,000

- Multi-party payments: [% of total]

- International payments: [% of total]

Processing Efficiency

- Current processing time: 5.5 days

- Target processing time: 1 day

- Touch points per transaction: 6

- Processing cost per transaction: [Current/Target]

Payment Types

- Direct client payments: [% of total]

- Participant payments: [% of total]

- Commission payments: [% of total]

Key Functions in Scope

Payment Processing and Distribution

Manages the end-to-end process of payment creation, approval, and distribution to clients. This function handles various payment methods, currencies, and jurisdictional requirements while ensuring accurate commission calculations and proper handling of special payment scenarios such as advances or loans. Handles payments to various third parties such as managers, lawyers, and business managers, ensuring proper distribution of funds according to agreed-upon terms. Processing includes managing payment splits, handling tax withholding requirements, and maintaining records of all distributions.

- Implements user-centric queue system showing pending tasks (new bookings, invoice requests, payment requests)

- Flags client booking milestones that have come due for payment

- Enables automatic payment processing when funds are received and services are verified (e.g., Finals submitted and approved)

- Supports payments to all participant types (managers, lawyers, business managers, co-agents, UTA)

- Handles pass-through (commission-free) payments to parties such as buyers, clients, or vendors

- Provides the ability to process multiple payments against multiple bookings on a by client basis

- Manages buyer overpayment returns with appropriate tracking

- Processes client payments as individual or batch transactions

- Provides remittance details to all client team members

- Allows withholding of client commission across multiple bookings with appropriate approvals

- Enables payment processing from multiple UTA accounts with appropriate transfers

- Supports client loans/advances with recoupment tracking

- Handles tax withholding requirements including Central Withholding Agreements

- Integrates with expense systems (Concur) to recoup agent expenses from clients/buyers

- Provides functionality to place client payments on hold with agent notification

- Automatically calculates the participant splits based on authoritative data/booking records with the option to edit payments if needed

Approval and Control Workflow

Implements an integrated, robust multi-level approval process ensuring proper review and authorization of all payments. This function manages the routing of payments through appropriate approval channels, maintaining separation of duties and proper documentation of all approvals.

- Generates pre-settlement statements for agent/assistant review before payment, with differing access per department

- Ensures DCA compliance and audit readiness

- Implements separation of duties between Cash Receipts team and various levels of Accounting Representatives

- Maintains comprehensive audit trails of all approvals

- Documents exceptions and special handling cases

Open Items

UTA could explore fintech partnerships that enhance payment capabilities and reduce operational costs. Such partnerships could enable streamlined disbursement and collection processes, automate KYC compliance, and expand payment options for clients. This avenue warrants investigation as UTA evaluates ways to optimize its payment flow while maintaining control of the marketplace

Key capabilities are included in Appendix E.

A/R and Bad Debt

Overview

The accounts receivable and bad debt management function provides tracking and management of receivables. It handles aging, collection activity, and write-off processing. It provides capabilities for managing collection workflows, tracking communication history, processing write-off approvals, and maintaining collection documentation. It bases Aging and collections reporting on total amount receivable while G/L balances are only based on UTA commission. It supports various reporting and analysis needs while ensuring proper handling of both standard collection processes and exceptional cases.

Key Metrics

AR Portfolio

- Total outstanding receivables:50,000 open items, 11,000 past due (Feb 2025) [Metric needed]

- Error rate in cash handling: 0.2%

- Revenue opportunity: $6 million annually

- Average days outstanding: [Metric needed]

- Collection success rate: [% by aging]

Collection Performance

- Collection effort per dollar: [Metric needed]

- Average resolution time: [Days by type]

- Customer contact rate: [Touches needed]

Key Functions in Scope

Receivables Tracking and Aging

Provides tracking of all receivables, including aging, collection status, and payment history. This function supports various views and analysis tools to help accounting representatives and agents monitor and manage outstanding receivables effectively.

- Gives accounting representatives real-time visibility into open AR for their clients/bookings

- Provides search capabilities for team members across all departments in support of flywheel opportunities

- Provides dynamic AR sorting capabilities by multiple criteria (Agent, Client, Department, etc.)

- Tracks payment history for each receivable

Collection Management

Facilitates the collection process through automated reminders, communication tracking, and workflow management. This includes tools for managing communication with buyers and clients, tracking collection efforts, and maintaining detailed records of all collection activities.

- Enables direct communication with agents/assistants from booking records/receivables

- Provides fields for tracking Verification Status and Collection Notes

- Allows access to original invoices for redistribution

- System automatically follows up with buyers and clients on open invoices and posts information to the client/buyer portal

- Tracks "last followed up date" for each AR line item

- Manages collection activities with full audit trail

Write-off Processing

Manages the workflow for processing write-offs, including initiation, approval routing, and final processing. This function ensures proper documentation and approval of all write-offs while maintaining accurate records for reporting and analysis.

- Allows accounting representatives to initiate write-off requests directly to agents/assistants for approval

- Implements dual approval requirement (Agent group and Finance group)

- Generates automated journal entries for approved write-offs

- Maintains documentation of write-off reasons and approvals

- Preserves write-off history for future reference

- Allows for write off recovery if previously written off funds are collected

Reporting and Analysis

Provides reporting tools for analyzing receivables status, collection effectiveness, and write-off trends. This includes both standard reports and flexible analysis capabilities to support various stakeholder needs.

- Enables accounting representatives to generate their own AR aging reports

- Supports exports to PowerBI or other systems for dynamic visualization for Accounting leadership and agents

- Includes write-off items in dynamic reporting for revenue department review

Open Items

[None noted]

Key capabilities are included in Appendix F.

Revenue Recognition

Overview

The revenue recognition function manages the recording and tracking of revenue in compliance with accounting requirements. This function handles various revenue scenarios including guaranteed payments, contingent compensation, and package deals. It provides capabilities for verifying service delivery, managing revenue timing, tracking contingent terms, and supporting analysis needs. The function maintains documentation of revenue decisions while supporting both standard processing and complex revenue arrangements.

Key Metrics

[Need metrics]

Key Functions in Scope

Revenue Verification Processing

Manages verification of revenue recognition criteria, including confirmation of services rendered and tracking of contingent revenue conditions. This function supports both automated and manual verification processes while maintaining documentation of all decisions.

- Provides a dedicated Verify Bookings tab for monthly verification process with a predetermined threshold on commission amounts by line

- Tracks contingent revenue conditions

- Supports both automated and manual verification processes

- Allows for control signoff within the system

Performance Tracking and Analysis

Provides tools for analyzing revenue trends, seasonality, and performance metrics across departments and deal types. This function supports both historical analysis and forward-looking forecasting capabilities while integrating with various reporting tools. Delivers reporting capabilities including trend analysis, departmental performance tracking, and various management reports. This includes integration with business intelligence tools and support for ad-hoc analysis needs.

- Enables quick generation of Automated Revenue Management reports

- Shifts in performance dates on booking lines are automatically calculated

- Provides trend reporting to identify seasonal patterns across departments

- Supports export to Power BI or other systems for FP&A and Revenue Department analysis

- Includes "Flywheel" reporting showing home department vs. other departments

- Delivers comprehensive reporting on revenue performance

- Supports ad-hoc analysis for management decision making

- Enables drill-down from summary to detailed revenue information

- Supports revenue Actuals vs. Budget, and YTD year over year comparisons by department

Open Items

[None noted]

Key capabilities are included in Appendix G.

Financial Transactions

Overview

The financial transactions function captures business activities in the client processing system and manages the interface with the general ledger (GL). This function handles the translation of operational transactions into accounting entries, ensuring proper financial recording. It provides capabilities for business activity collection, GL entry creation and transmission, analysis and reconciliation, and corrections and adjustments. The component ensures data integrity across systems while supporting accounting compliance and financial reporting needs.

Key Metrics

Transaction Volumes

• Daily GL entries generated: [Metric needed]

• Monthly transaction batches: [Metric needed]

• Correction frequency: [% of transactions]

• Reconciliation items: [Average per period]

Processing Performance

• GL processing time: [Current/Target]

• Reconciliation completion time: [Current/Target]

• Error rate: [Current/Target]

Key Functions in Scope

Business Activity Collection

Captures and records the business activities within client processing that have financial implications.

• Collects transaction data from all functional areas

• Applies business rules to determine GL impact

• Maintains audit trails of business activities

GL Entry Creation and Transmission

Manages creation of appropriate GL entries based on business activities and handles the transmission of those entries to the GL. This function applies accounting rules, derives GL coding, and maintains the link between operational transactions and resulting GL entries.

• Creates balanced GL entries (debits equal credits) for each accounting event

• Applies proper GL account coding based on transaction type and attributes

• Handles foreign currency transactions

• Manages accounting period assignments

• Implements controlled batch processing for GL transmission

• Maintains transaction identifiers that link back to source transactions

Analysis and Reconciliation

Provides tools and capabilities for analyzing financial data and reconciling client processing records with GL balances. This function implements regular reconciliation processes, identifies discrepancies, and supports resolution workflows to ensure data consistency across systems.

• Implements systematic reconciliation between client processing and GL

• Provides reconciliation reporting with exception highlighting

• Supports drill-down from GL entries to source transactions

• Supports automated matching of transactions where possible

• Maintains history of reconciliation activities and findings

Corrections and Adjustments

Manages the process for correcting errors and adjusting financial transactions. This function implements workflows for identifying, approving, and processing corrections while maintaining documentation and audit trails.

• Supports correction of transaction errors through reversing entries

• Implements approval workflows for financial adjustments

• Maintains comprehensive audit trails of all corrections

• Ensures proper period handling for adjustments

• Enables correction analysis and reporting

• Provides clear documentation of correction reasons and approvals

Open Items

The Financial Interface Scope & Capabilities document provides a more detailed description of required transactions. Significant items requiring additional analysis include foreign currency processing, intercompany accounting, and GL integration approach.

Next Steps

The Core Team and Key Stakeholders will review this document, verifying completeness and accuracy of the requirements. Following stakeholder approval, Engineering will analyze the specifications and develop detailed build estimates. These estimates will inform implementation planning, resource allocation, and budgeting for the project. This review and estimation process is expected to be completed by the end of Q2 2025, when the team will present a comprehensive implementation roadmap to management for approval.

Conclusion

The new UTA Client Processing System represents a strategic investment in UTA's core operational infrastructure that will transform how UTA manages its marketplace of buyers, clients, and participants. By addressing current system limitations through a modular, integrated approach, UTA will significantly reduce processing time from 5.5 days to 1 day, capture up to $6 million in previously lost revenue opportunities, and realize approximately $4.1 million in annual efficiency savings. Beyond these quantifiable benefits, the system will enhance the experience for clients, agents, and operations staff by providing real-time visibility, streamlined workflows, and sophisticated analytics capabilities. As deal complexity and transaction volumes grow, this investment ensures UTA maintains its competitive advantage as a premier global talent agency with capable and efficient financial systems.

Appendices

Appendix A: Booking Management Key Capabilities

| Function / Number / Capability | |

|---|---|

| Deal Management Integration | |

| 1 | Agent/Asst capability to enter deal (Pending/Confirmed/Cancelled status) from booking card/form in Booking System (CRM/Deal management). |

| 2 | Booking Slip status triggered to Accounting (within Client Processing System). Status to include Pending, Confirmed, Cancelled, Cancelled with Payment. |

| 3 | Booking Slip system information should funnel through populate a Booking Card in Client Payment Processing system. |

| 4 | Booking information populating Client Payment Processing system to include: Client, Loanout, Guaranteed Compensation with corresponding milestones, Contingent compensation (i.e. overages, buyouts, bonus etc.) Commission Rate, Booking Agent/Booking Team, Third Party participants, buyer name, buyer address, buyer contact information, Compensation notes, Invoicing contact information and notes. |

| 17 | Salesforce or something similar tracking opportunities and can pull in booking with contracts/ redlining accessible. Acct Reps must have access to Booking Slip system. |

| 18 | Booking Entry Templates in Deal Management to Auto populate by department |

| 21 | Flag when the deal is confirmed - trigger for booking entry down to client processing system |

| 22 | Agent/Assistant enters the deal in Booking system. That record flows through to Client processing system and populates the Acct Reps queue for their review and set up. |

| 29 | Attach contracts and statements to deals that can live within client processing system. |

| 30 | Deal analysis by buyer for negotiating leverage |

| 33 | Ability to mass upload bookings |

| Deal Lifecycle Management | |

| 9 | Client Processing System to include drop-down category for monthly Verification Status exercise (Verified, Unverified, Write-off, TBD) |

| 10 | Client Processing System to include note section on line level of compensation. AR notes, Collection notes, Invoice notes. |

| 12 | Dynamic reporting to include, Client Gross earnings, Client commission paid, Client AR aging, Gross paid to participants, Client statements by booking or bookings, any loan reporting with payout schedule |

| 13 | Each department (Talent, TV Lit, Music etc.) requires having their own booking code/departmental code that populates within the record upon entry. This is essential for dynamic reporting. |

| 14 | Each booking should require an Occupation Code to be input on new booking entry. This will help with avoiding issue with cross-departmental booking(s). |

| 20 | Buyer/Production contacts listed on booking so we can chase money |

| 24 | No more confidential deals. All deals should be considered confidential. |

| 26 | Buyer data should be uniform |

| 28 | Package tracking and management with hierarchy |

| 31 | Capability to export bookings/earnings into Power BI |

| 34 | Subsidiaries |

| 35 | Role assignments within the Client processing system |

| 36 | Linking packages with hierarchy |

| 37 | Linking of projects |

| 38 | Occupation code definitions available for Acct reps to review. |

| 103 | Ability to upload of documentation from venues, bookers etc. |

| 111 | Direct data flow to and from CRMs via Deal Management |

| Change Control and Version Management | |

| 11 | Changes to bookings (comp, contacts, dates, status etc.) must funnel through to client processing system. These changes must populate the queue for Acct reps/SalesOps to review and work off of. |

| 19 | Change Requests are tracked in system (not relying on email) |

| 39 | Dynamic reporting capability to view changes to booking compensation on all bookings |

Appendix B: Settlement Key Capabilities

| Function / Number / Capability | |

|---|---|

| Financial Terms Processing | |

| 5 | Compensation and contract details to auto populate on booking card in Client processing system upon estimated confirmation from Agent/Asst inputting within the Booking Slip System. |

| 6 | Compensation milestones to be reviewed by Acct Rep and set up on receivables lines Client processing system. |

| 7 | Accounting capability to edit wording on milestones. |

| 8 | Accounting capability to edit service dates, compensation against guarantee (not to exceed guarantee). |

| 15 | Acct Reps/Sales Ops require visibility of clients open AR cross-departmentally. |

| 16 | Payee splits are determined by master client record |

| 23 | System must have capability to allow Agent allocations (Booking Agent, RA, Agent team) |

| 25 | Ability to account for deals booked in a foreign currency. |

| 27 | Profits participation tracking - statements and dates –emails. High level of granularity. |

| 32 | 1099 reporting capability required. |

| Settlement Management | |

| 11 | Batches of settlement/payments should include a batch summary journal detailing the prepared settlements. |

| 12 | Batches of settlements should include the incoming payment (Deposit) remittance back up. |

| 18 | Pre-settlement Statement should summarize the breakdown of payment with detailed line items. |

| 19 | Pre-settlement Statement should allow for settlement notes to be input by processor/SalesOps. |

| 22 | Batch settlements can include commission rebates or commission reimbursements to clients within the batch. |

| 24 | Capability to process and apply Direct Commission payments directly to the open AR item. |

| 25 | Direct Commission defined: Incoming funds from Client or Buyer that account for only UTA's commission portion. |

Appendix C: Cash Receipts Key Capabilities

| Function / Number / Capability | |

|---|---|

| Cash Receipt Processing | |

| 1 | Cash receipts require a queue/list that comprises all incoming electronic payments and physical checks received by Lockbox (Unassigned/New/Applied). Client processing system requires full integration with banking platform that pulls this information periodically throughout the day. |

| 2 | Cash receipts require working off a deposit portal or deposit queue that is populated throughout the day upon receipt of new payments to UTA bank(s), electronic payments (ACH/wire), physical checks, credit card or otherwise. |

| 3 | Deposit queue needs to account for all accepted currencies of incoming wires to UTA. |

| 8 | Deposit queue needs to be visible within the Booking slip system to enable Agents/Assistants to have access and ability to assist with assigning funds. |

| 14 | Client processing system needs to speak back to the Booking slip system to reflect any funds deposited/applied to a booking record. |

| 106 | Systematically link cash accounts to currency on the deal so cash account currency doesn't mismatch |

| 107 | Support payments from Clients and Buyers via credit cards |

| Cash Matching and Allocation | |

| 5 | Deposit queue should allow for assignment of a UTA client, booking number, or invoice to match. |

| 7 | Deposit queue listing Incoming/Unclaimed wires should be easily distributed to Agents/Assistants or at a minimum, accessed for assistance with claiming and assigning the funds. |

| 10 | Cash receipts need ability to post/apply funds to bookings or client. Does not need to have an invoice to match. |

| 11 | Cash receipts need ability to split deposit funds across multiple clients or multiple booking lines. |

| Exception Management | |

| 6 | Deposit queue should allow for a notes section for any pertinent information from Cash Team/Acct Reps. This will assist with wire/ACH assignment. |

| 12 | Cash Receipts/Acct Reps to have capability to transfer funds across Clients/Client Bookings. |

| 13 | If funds are sent to UTA incorrectly, processors must have the ability to indicate to Cash team that funds be returned to sender. |

| Bank Integration and Reconciliation | |

| 4 | Deposit queue should be easily sorted by currency, date etc. |

| 9 | Incoming checks from UTA Lockbox should contain the check back up in PDF form. This should live with the deposit record systematically through the life of the funds within the Client Payment Processing system. |

| 15 | Acct Reps should have view-only access to bank account to reference incoming wire/ACH funds to assist with the deposit application process. |

Appendix D: Invoicing Key Capabilities

| Function / Number / Capability | |

|---|---|

| Invoice Generation and Management | |

| 3 | Assistants need capability to generate an invoice from the Booking slip system. This generated invoice needs to stem to the Client processing system. |

| 4 | Invoice requests should contain client, booking number, milestone(s) to be invoiced, compensation amount(s) also to include VAT where necessary. Consider any additional EU requirements for payment. |

| 5 | Acct Reps to open the booking slip detail that contains the booking milestones and guaranteed earnings, wherein they can select a line or multiple lines to invoice. |

| 6 | Acct Rep should be able to generate invoice records from multiple areas within the Client processing system. |

| 10 | Invoice function should allow Acct Reps to select buyer invoice or client invoice. |

| 11 | Client processing system should host invoicing templates that are dynamic and editable |

| 12 | Buyer invoice reflects earnings due to Client. |

| 13 | Client invoice reflects commission owed to UTA. |

| 14 | Invoice function should automatically select correct UTA bank/wire details based on the currency in the booking record. |

| 16 | Invoices should be editable/flexible. |

| 17 | When an adjustment to an invoice is made, it should have no effect on the General Ledger. |

| 18 | Invoices are not required to apply and process funds. However, they should be autogenerated and closed once payment is posted in the system. |

| 19 | Acct Rep to have capability to invoice one or multiple lines of AR |

| 104 | Agents can add notes for statements |

| 105 | Consistency of design and output across financial statements, easy to read and easy to understand |

| Workflow and Approval Processing | |

| 1 | Systematic request capability. Stemming from Booking system, Slack, or otherwise, to an accounting queue that lives within the Client Processing System. |

| 2 | Explore possibility of having a separate queue for Invoicing requests that stem from Agents. |

| 7 | If further information is required, communication via the Client Processing system to the requestor (agent/asst) in a dialogue can be tracked, stored and referenced at a later date. |

| 112 | Ability to set up approval requirement e.g., agent must sign approval final before financials issued |

| Distribution and Tracking | |

| 8 | Invoices should be systematically distributed to the buyer contact or invoicing contact denoted in the booking card. |

| 9 | Invoice record should live on the line level (milestone or milestones) of the booking card and accessible in perpetuity. |

| 15 | Invoice should contain the Acct. Rep email information in the event of questions. |

| 20 | Open discussion with IT on Buyer self-serving invoicing process. |

| 21 | Column/Field indicating # of days has passed since invoicing. |

| 109 | All financials can be pulled based on identities - clients, venues, bookers, etc. |

Appendix E: Client Payments Key Capabilities

| Function / Number / Capability | |

|---|---|

| Payment Processing and Distribution | |

| 1 | Client processing system should host a queue that is user centric. This will be their working "to-do list". |

| 2 | User queue should also reflect client booking milestones that have now come due. |

| 3 | If UTA receives money and funds are cleared for an exercised milestone where services have been rendered, processor should proceed with payment. |

| 6 | Payment capability for all participants that are active on the booking record. This includes third parties such as Managers, Lawyers, Business Managers, co-agents. |

| 7 | System must allow for pass through (commission free) funds to be paid to parties such as buyers, clients or vendors. |

| 8 | System must allow for any buyer overpayment, that is recognized, to be paid back to the buyer. |

| 9 | Client payments can be submitted as a batch of 1 or multiple payments. |

| 10 | The batched Commission, once posted, should post/transfer to the Commission account automatically. |

| 16 | Fully approved batches released should systematically provide remittance/payment back-up to all members on Client team. |

| 17 | System should allow for client commission to be withheld from multiple bookings. |

| 20 | Remittance/Statements to populate Client's portal upon payment being released to client. |

| 21 | System to account for Auto Debit Clients that get commission payments automatically deducted. |

| 23 | Ability to process cash out of other UTA accounts. |

| 28 | Capability to issue a Client Loan or Client Advance and code it as such for recoupment purposes. |

| 29 | Client loans or Client Advances should be accompanied by a promissory note generated by Legal. |

| 30 | Capability to withhold funds for tax purposes. Or account for CWA. |

| 31 | Integration for Client booking records with Concur. |

| 32 | Capability to flag a Client Hold. |

| 101 | Payment triggered based on criteria e.g., Once finals are signed off then then client is paid |

| 114 | Settle owed amounts with future deposits e.g., client owes 10% from previous project, UTA pulls that % from next payment (toggle on if client agrees) |

| 115 | Live visibility to payment status |

| Approval and Control Workflow | |

| 4 | System should generate a pre-settlement statement that can be reviewed by Agents/Asst/Client Team members prior to payment going out. |

| 5 | Settlement work that Acct Reps generate should live in draft form until they submit in an actual batch of work to be reviewed/audited by Acct Mgr. and Cash Team. |

| 13 | Batches of settlements are to be systematically sent to an accounting manager for first round of audit approval. |

| 14 | Batches of settlements are to be systematically sent to a Cash Team member for a secondary round of audit approval. |

| 15 | Fully approved batches to be released for payment by Cash Team member. |

| 26 | Client processing system should provide DCA compliance / audit compliance and readiness. |

| 27 | Client processing system should have capability to differentiate and set segregation of duties between Cash Receipts team and Acct Reps. |

Appendix F: A/R and Bad Debt Key Capabilities

| Function / Number / Capability | |

|---|---|

| Receivables Tracking and Aging | |

| 1 | Acct Reps require capability to see open AR at all times for the clients and/or bookings they manage. |

| 2 | Acct Reps to have capability to sort AR dynamically: By Agent, By Client, By Dept etc. |

| 113 | Ability to manage overpayments |

| Collection Management | |

| 4 | Communication to Agents/Assts from the Client processing system directly from the booking record/receivable in the system. |

| 5 | Compensation line items require a field for the following: Booking Verification Status and Collection Notes. |

| 6 | Capability to access original invoice and redistribute to receiving parties. |

| 7 | AR line items to include a column/field for "Last followed up date" |

| Write-off Processing | |

| 8 | If SOP's/Processors inquire to write-off an AR item, they should be able to inquire directly to Agents/Asst from the Client processing system to start the approval process. |

| 9 | Write-off functionality. This can be flagged within the Booking system to flow through and be reflected in the Client processing system. |

| 11 | The write-off process requires dual approval. 1 from Agent group and 1 from F&A group. |

| 12 | Automated journal entry population. |

| Reporting and Analysis | |

| 3 | SOPs/Processors require capability to run their own AR aging reporting for review with Agents and assist with collection efforts. |

| 10 | AR items that have been coded/categorized as Write-Off should funnel through into dynamic reporting that can be pulled at any time for revenue department to review. |

| 102 | Archival of documentation, saving invoice, settlements etc. that can be pulled at later dates. |

| 108 | Analytics on bookers, venues, clients shared across departments |

| 110 | Index of entries ability to allow for efficient search |

Appendix G: Revenue Recognition Key Capabilities

| Function / Number / Capability | |

|---|---|

| Revenue Verification Processing | |

| 1 | Client processing system to host a Verify Bookings tab that will allow SOPs/Processors to conduct their monthly verification process on open AR. Verified bookings defined as services rendered and money is due to UTA. |

| Performance Tracking and Analysis | |

| 2 | Client processing system to have capability to pull an ARM type report quickly at any time. ARM defined: Automated Revenue Management |

| 3 | Trend reporting in Revenue. Reflect which seasons are busier across the multiple departments. |

| 4 | Trend reporting capability to be exported into Power BI for FP&A and/or Revenue Department for more dynamic reporting. |

| 5 | Flywheel reporting. Defined: Acct Reps home dept vs other departments. |