Client Processing

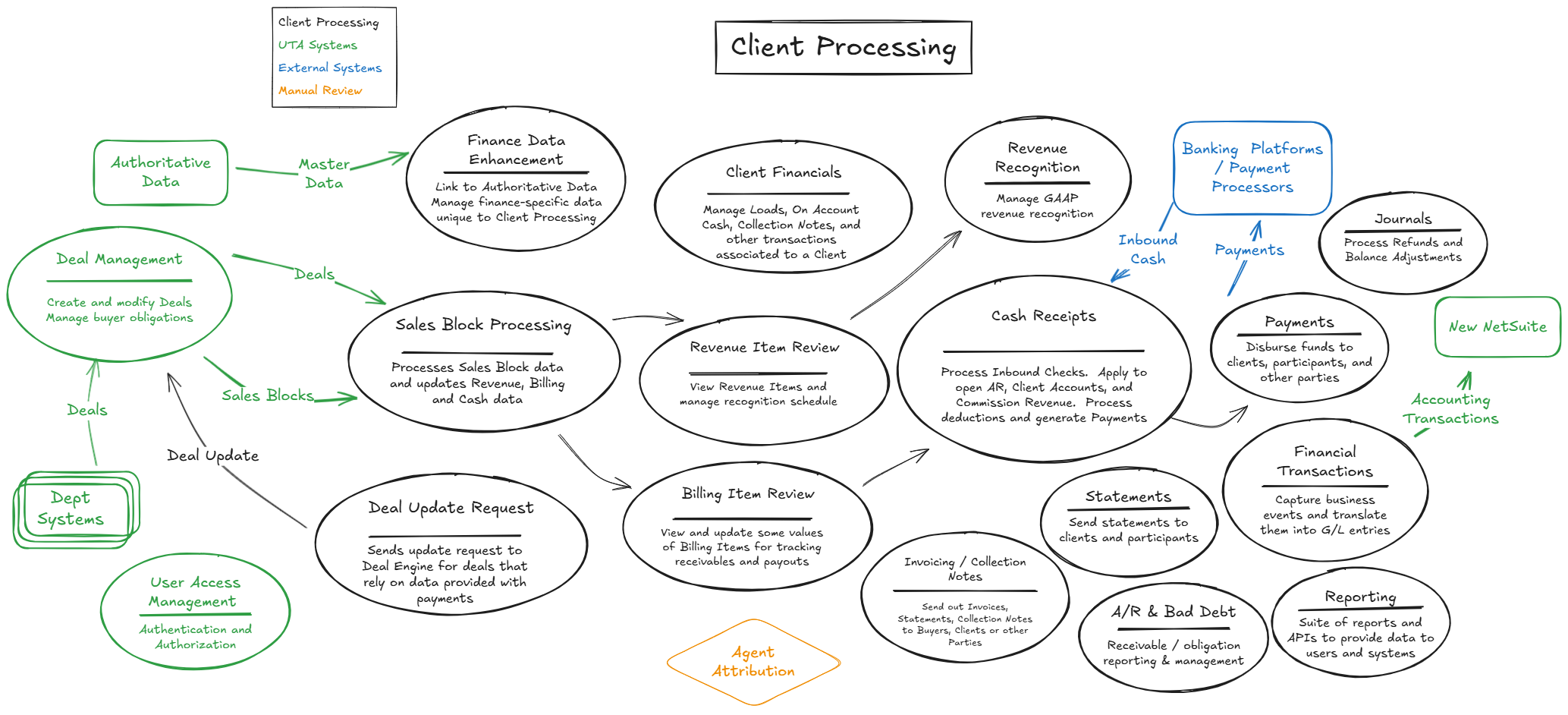

The UTA Client Processing System serves as the core financial platform that enables the agency's business operations. The system facilitates transaction flow between buyers, clients, and participants while providing the tools and capabilities needed for effective marketplace operation. Through integrated components handling different aspects of financial processing, the system supports UTA's ability to manage complex deal structures, process transactions efficiently, and maintain high service levels for all stakeholders.

Client Processing fills a key component of the overall Client Framework ecosystem.

.Cc3z1OeJ.png)

Client Processing functions and requirements are organized into 11 areas and is fully described in the functional overview.

- 01. Client Finance Data Enhancement — Manages addition of Client Processing required finance-specific data to underlying Authoritative Data records.

- 02. Sales Block Processing — This function accepts updates from the Deal Engine and provides workflows for processing them. This includes approvals, guardrails, change tracking, and finally updating the state of billings, revenue and cash.

- 03. Revenue Item Review — Shows the current state of revenue and the recognition schedule. Allows for change auditing and schedule updates. Users will also be able to trigger deal update requests from here.

- 04. Billing Item Review — Shows the current state of payment terms and receivables being tracked. Allows users to adjust deductions, collection styles, notes, and other aspects. Users will also be able to trigger deal update requests.

- 05. Deal Update Requests — An event generated by the system in response to rules or user actions. Starts a workflow in deal engine to update milestones, revenue amounts, dates, payment terms, or other deal data.

- 06. Client Financial Transaction — Displays and allows management of client specific financial situations like loans, on account cash, collection notes, write-off request, or other financial specific to the client.

- 07. Revenue Recognition — A backed process that processes the current state of Revenue Items and generates Financial Transactions to be sent to Netsuite.

- 08. AR and Bad Debt — Provides workflows to request and approve AR Adjustments and Write-offs to handle revenue that need to be written off or deducted outside of the Deal Engine.

- 09. Cash Receipts — This is the heart of Client Processing. Cash comes in from the Bank and this module provides tools for processing it. It is responsible for matching cash to Clients and Deals, clearing open AR, record deductions and withholding, generating Deal Update Requests, splitting to participants, and generating Payment Requests.

- 10. Payments — These are requests to pay a party. They can be generated from Cash Receipts, Journals, or upon user request. They can incorporate workflows for approvals and the scheduling of payments to be sent immediately or in the future.

- 11. Journals — A process for adjusting balances such as applying on account money, issuing refunds, or other actions requiring a zero balance cash adjustment.

- 12. Invoicing and Collection Notes — This allows for the generation and sending of invoices or collection requests to Buyers, Clients, or any other party. It has workflows for system generation, finance user request, or external parties and systems to request for documents to be generated and sent.

- 13. Statements — This module allows users to generate and send statements to Clients or Buyers or other parties. It has workflows for system generation, finance user request, or external parties and systems to request for documents to be generated and sent.

- 14. Reporting — A combination of canned reports along with dashboards and custom views to help users view the data and workflow status. APIs will also be exposed for external reporting needs

- 15. Financial Transactions — All transactions in Client Processing will be modeled to match the data and not modeled as Debits and Credits. The system will translate that activity into compliant accounting data that will be used for specific financial reporting and for feeding to the Netsuite GL.

Additional background detail on required scope and capabilities for Client Processing is included in the Client Processing Scope and Capabilities document, Version 4, dated May 6, 2025.