UTA CLIENT FRAMEWORK – PROJECT OVERVIEW

Document Purpose

The purpose of this document is to align the approach and scope for building a new global client framework and processing system for United Talent Agency (UTA) that is set to scale while achieving a positive client, agent and operational experience.

Management and the audit committee have approved the scope described here, allocating budget and resources to a priority initiative extending beyond 2026. This approval includes budget for detailed discovery which began in Q1 2025.

The detailed discovery phase has been completed and presented to management, establishing a comprehensive project plan including costs, timelines, and program management approach.

Context

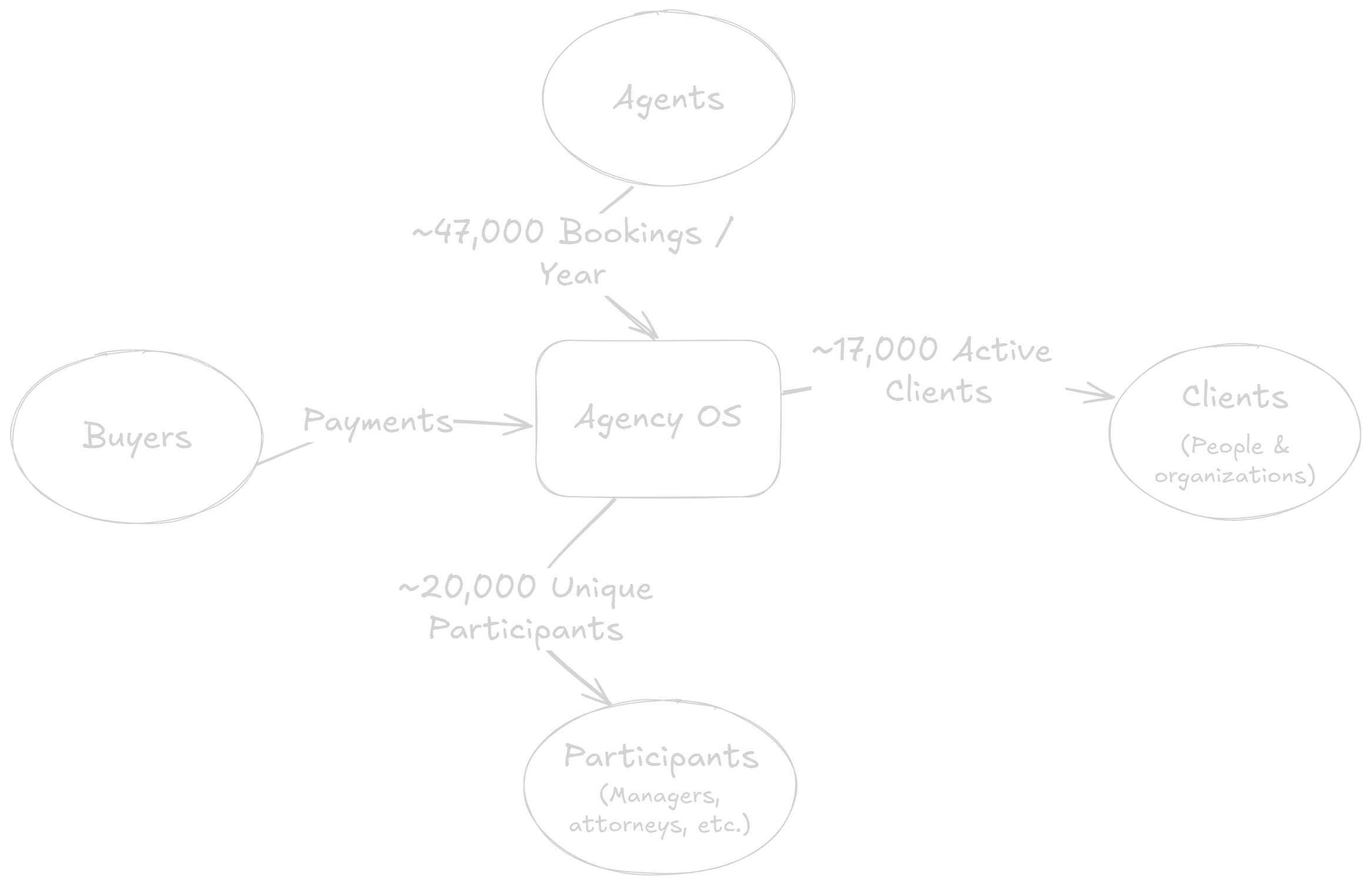

UTA, a global leader in the talent, sports, and entertainment industries, represents over 10,000 clients worldwide. As an agency, UTA's core business revolves around connecting clients with buyers—ranging from studios to brands and promoters—to generate bookings. Agents manage opportunities and bookings in CRM systems, which are then passed on to financial systems that manage cash receipts and payments to clients in a process called "client processing." Achieving high client satisfaction, maximizing agents' booking opportunities, and accurately recognizing revenue depends on strong end-to-end support from booking to contract to cash receipt and disbursement.

UTA initiated a series of programs to provide this integrated support for the booking-to-cash process. These programs include CRM system expansions, enhancements to data and contract management, but do not address weaknesses in client processing. This document outlines the need to enhance client processing as part of upgrading the entire booking-to-cash process.

Historical Background

In response to a shift from the cash method of accounting to US GAAP, UTA was required to move away from its existing processing platform, Avalon, and developed Opal. Unfortunately, the rushed implementation of the new system, compounded by the impacts of Covid, resulted in poor execution with limited results. Furthermore, the rushed execution lacked consideration around aspects of client relationship management and consideration for ongoing data management. Most importantly, the overall project did not take user experience into account leaving both external and internal "clients" with no real-time information transfer nor any meaningful reporting functionality.

Current Business Challenges

The failed implementation of Opal has led to mistakes, multiple handoffs, and poor execution, affecting not only financial accuracy but client and stakeholder relationships. Clients, participants, buyers, and agents all rely on efficient and accurate financial operations. Clients who are not paid quickly and accurately are at risk of leaving the agency; inaccurate buyer invoices can harm the agency's reputation; incorrect banking information for a participant will sour a relationship with a manager that works with many of our clients.

Since Opal's implementation in 2021, daily bookings have increased significantly and nine major acquisitions have been made. Opal has not kept pace with this growth in volumes and complexity. This growth, combined with a lack of systems, has resulted in UTA manually patching the process with expensive people rather than automation. Major acquisitions were made in that same period resulting in the use of additional bespoke systems with no plan of global migration to a primary systematic platform. We are not set to scale and current systems cannot adequately support this growth.

Scale and Growth Challenges

The agency processes hundreds of payments daily with significant transaction volumes. Current metrics indicate extended processing times from cash-in to cash-out per booking, leaving substantial funds "in flight" at any time. The accounting teams touch each transaction multiple times, creating thousands of individual touchpoints annually with associated costs.

Competitive Positioning

UTA serves a marketplace of buyers (studios, brands, promoters, etc.) and sellers (clients, managers, attorneys) where its financial platform should serve as a key differentiator. However, while competitors invest in advanced systems to empower teams, streamline processes, and enhance client experiences, UTA remains stagnant with subpar client processing capabilities. This lack of innovation prevents UTA from leveraging its market-making role to grow its take rate and provide a standout experience for marketplace participants.

By addressing limitations in current systems and processes, UTA can reduce processing time, improve accuracy, and create a better client and agent experience. An effective client processing solution can empower agents and finance teams to make better deals faster, collect revenue quickly, pay participants accurately, and allow the agency to separate itself from its competitors.

Current Business Impact

The ineffective system environment results in high effort and high headcount to support the white-glove level of service that differentiates UTA. This dependence on manual, human-driven processes increases costs and limits scalability. Additionally, the lack of a comprehensive view of client activity hinders UTA's identification of opportunities to generate more revenue for clients and the agency. Inaccurate and inflexible reporting further prevents effective analysis of agent performance.

Problem Areas

The following section details gaps in the current environment:

Cash Flow and Processing Efficiency

Problem: Time between cash receipt to distribution is too long.

Impact: Clients, Agents - Processing inefficiencies

Details: Processing incoming funds to be paid to clients can require multiple people and handoffs. Different teams own certain areas of the system, driving multiple hand-offs. While process improvements have reduced touchpoints, current system limitations limit further improvement. Effective processing would have cash received and paid on the same day.

Problem: UTA's cash application process is overly complex and inefficient.

Impact: Clients, Agents - Processing inefficiencies

Details: Buyers and clients often remit payment with little or no detail. The finance team must identify where to apply cash and provide timely visibility to the appropriate accounting representative and agent office. The longer the application takes, the longer it takes for a client to be paid and an agent to earn commission.

Problem: UTA lacks sufficient options for receiving buyer and client payments.

Impact: Buyers, Clients - Client and buyer dissatisfaction, potential lost revenue

Details: Currently, UTA cannot easily expand universal buyer and client payment methods (e.g. Credit Cards). UTA cannot process direct commission payments from clients, creating additional communication/process time to process payment.

Data Quality and Management

Problem: UTA lacks accurate and authoritative data about clients, buyers, and business partners, costing time, money, and lost opportunities.

Impact: Clients, Agents, Operations - Revenue opportunity loss

Details: Current systems are siloed and connected by manual efforts to match data between systems. Without a unified, authoritative system of record for key entities (clients, buyers, participants) systems cannot reliably share data about those entities. The lack of a common, coherent "client team" structure hinders financial and compensation planning and limits flywheel opportunities. This lack of good data about our core entities has resulted in significant ad hoc software development and integration work, further exacerbating financial and management reporting difficulties.

Problem: UTA's client onboarding and offboarding processes are ineffective.

Impact: Clients, Agents - Revenue opportunity loss

Details: Current onboarding and offboarding processes are manual and disconnected, leading to duplicate records, inaccuracies, and ad hoc changes leading to errors in client records. Lack of tracking and notification of departing clients prevents consistent triggering of protection processes and risks revenue loss for UTA.

Revenue Tracking and Financial Management

Problem: Manual revenue tracking is effort-intensive, error-prone, leads to lost revenue opportunities, and delays cash receipts (if collected at all).

Impact: Clients, Agents, Operations - Revenue loss potential

Details: Some deal financial terms are simple (e.g., guarantees, or milestone payments), while others are quite complex (e.g., contingent compensation structures built from client or project performance expectations involving specific bonuses). Complex financial terms are difficult to track on the client's behalf, and if not carefully monitored, result in lost or delinquent revenue. This has resulted in large cleanup projects surrounding both UTA packages and profit participation bookings. With proper systematic checkpoints on contingent compensation and backend milestones, we remove the risk of leaving revenue on the table.

Problem: UTA lacks effective tools for generating accurate forecasts and tracking performance.

Impact: Operations - Inefficient budget and forecast process

Details: While simple deals are predictable, contingent, back-end compensation structures are not tracked in a consistent way. This results in difficult categorization of potential revenue (guaranteed vs contingent), preventing accurate matching of performance to each area.

Problem: Financial reporting is highly manual.

Impact: Agents, Operations - Significant annual labor costs

Details: Across multiple departments, Operations staff receive report requests related to clients and/or booking financials. Often this requires a custom generated report within the current platform, which requires significant labor hours per year. For example, an open AR per client report for the music co-heads can take hours to build. With one request per week, this creates substantial effort annually.

System Integration and Visibility

Problem: UTA cannot provide real-time visibility into booking data changes for agents and client accounting team.

Impact: Agents, Operations - Revenue loss potential

Details: The current client processing system logs and maintains a history of changes. However, booking changes are not logged and not pushed out of the client processing system. Communication of changes is via email or phone, increasing the risk of inaccurate data and preventing review of changes.

Problem: Lack of visibility into pending deals hinders accurate forecasting.

Impact: Agents, Operations - Inability to optimize bookings for clients and UTA

Details: Departments use everything from spreadsheets to Airtable databases, to Salesforce, and custom applications for tracking their opportunities, making it difficult for us to get a forward-looking view of the agency's entire pipeline.

Problem: UTA's reliance on ad hoc integrations raises costs and security risks.

Impact: Clients, Operations - Significant annual maintenance costs

Details: Agents use a variety of tools, some built by the Tech team, for tracking opportunities. Many departments are requesting direct integration with client processing to create bookings and to retrieve deposit and payment data. The ad hoc nature of these requests is taxing the finance systems team's capacity and are costly to maintain. In addition, as the data is downloaded into local systems within UTA, we increase security risk by losing the ability to determine who has access to what.

Proposed Solution

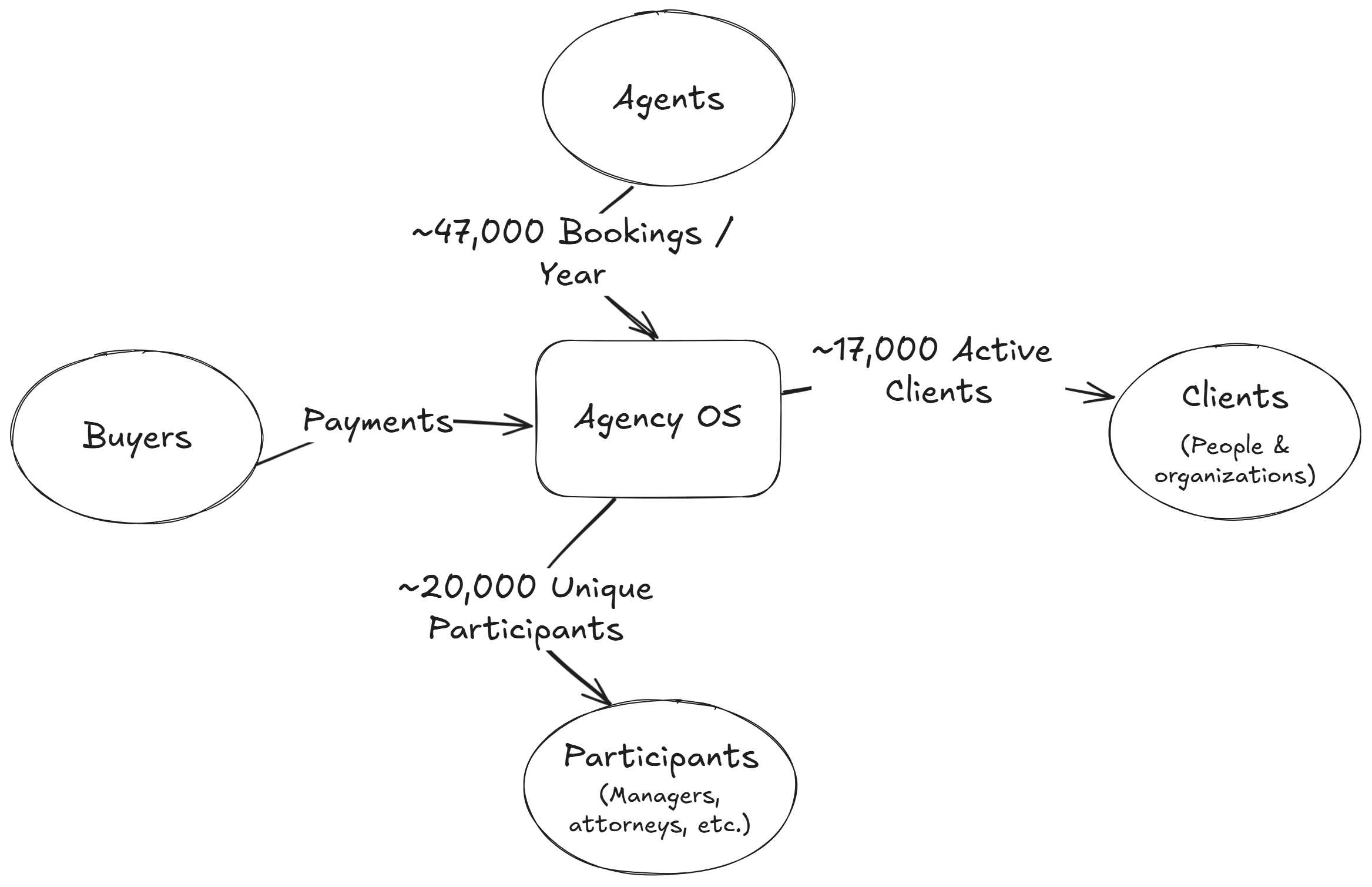

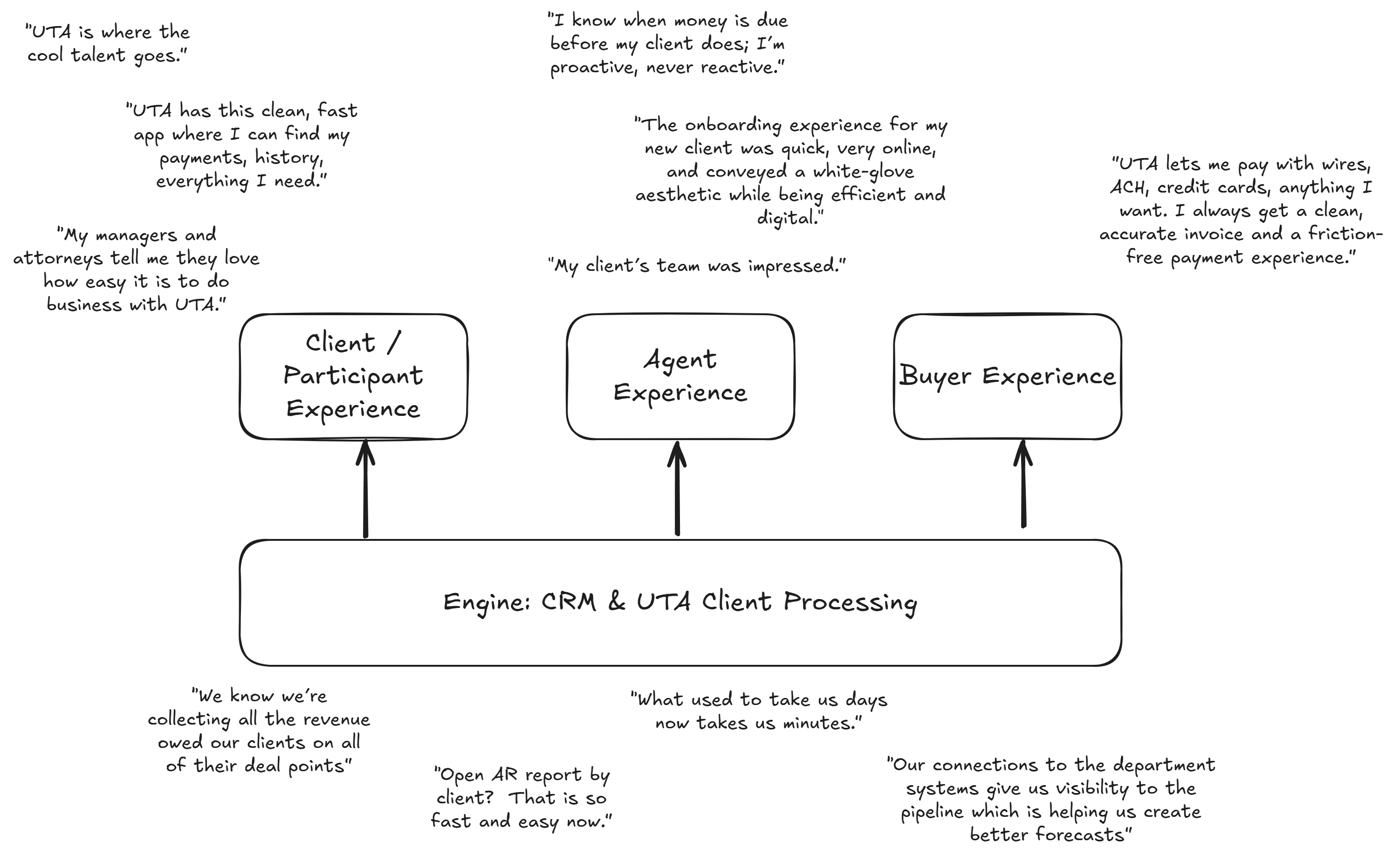

To address these problems, we intend to ensure our efforts encompass client, agent, buyer, and finance experiences:

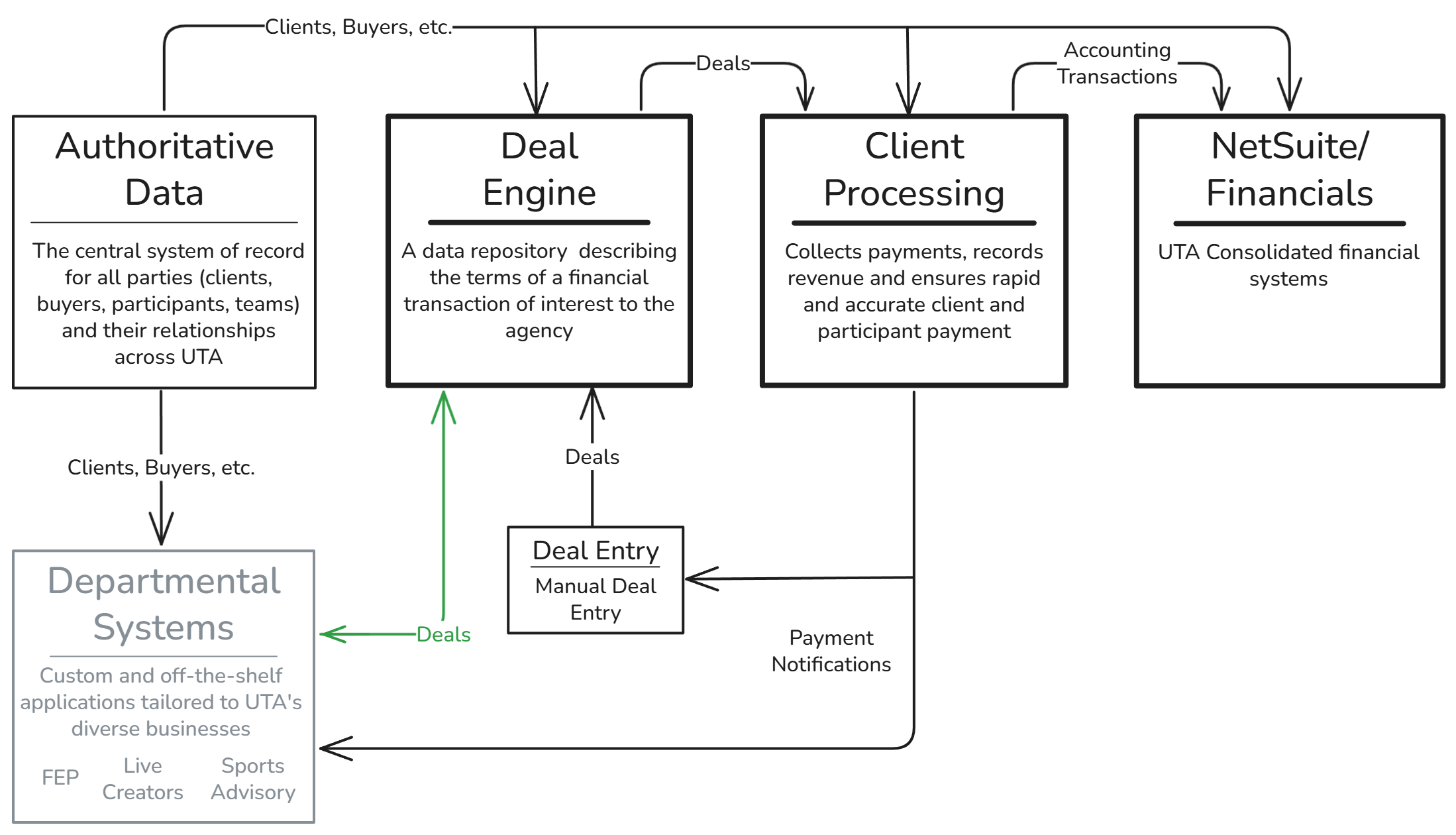

The proposed solution breaks out the client framework effort into five components:

An authoritative data management capability used by all systems at UTA. This in-flight Tech Group initiative includes Finance as a core stakeholder. For the purposes of this document, the additional scope would ensure that both the Enterprise Resource Planning (ERP) system (NetSuite) and the proposed client processing system connect to authoritative data. This addresses the problem of disparate, divergent, "siloed" data described earlier.

Department-level Customer Relationship Management (CRM) applications provisioned by the Tech group that are tailored to the department's workflows. This is where the agent's experience will be focused. These could be either internally developed applications or off-the-shelf solutions. In either case, the CRM communicates agent entered bookings into the client processing system and receives notifications and records of payment transactions against those bookings. The development of specific departmental CRM applications is out of scope for this client processing system effort since it is our intent to have harmonization across the organization. In this project we shall precisely define the touchpoints and permissions for departmental CRMs to communicate directly with client processing in a standardized manner.

A client processing application hosted outside of the ERP system, built and maintained by UTA. Unfortunately, it is not possible to buy an off-the-shelf solution for agency management which covers all the use cases of an agency the size and scope of UTA. Every large agency has written their own client processing system (sometimes called "trust accounting"). This is one of two primary items in scope.

A deal management capability that standardizes financial deal term descriptions at a level of granularity that addresses the problem of lost revenue, proactive revenue collection, and deal analysis for both sellers and finance. This is the second of the two primary items in scope.

An ERP system (what we currently call "new NetSuite") with a limited standard interface for client processing to use when communicating with NetSuite. Financial transactions from client processing would be posted to the ERP as standard NetSuite transactions.

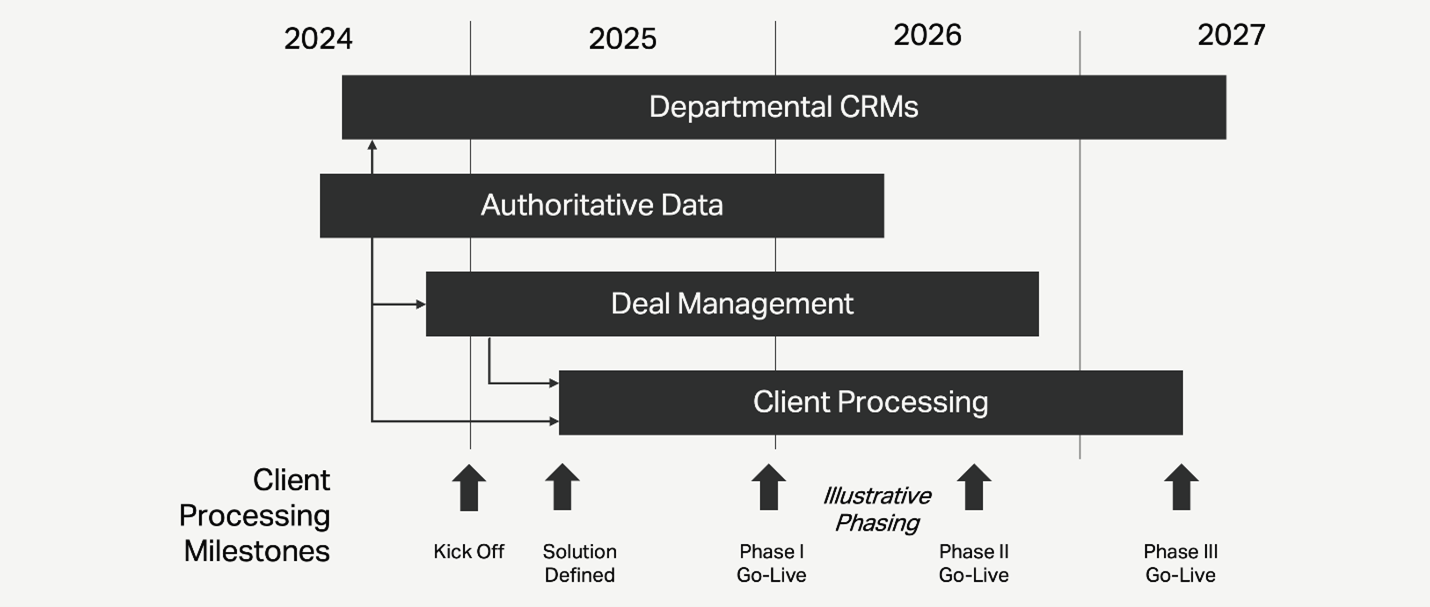

Sequencing

These components of the client framework will be developed as an integrated program over the next several years, with careful planning to ensure proper coordination and integration between components.

FAQs

Who are the key business sponsors for this initiative?

In Finance: Chris Jefferis, Lyndsay Harding

In Technology: Eric Iverson

Core team: Kristen Stewart, Scott Murphy, Anthony Jorge, Alan Nafziger, Glenn Scott, Delaney Voogd

Who are the primary customers/users of this work?

Client processing should be considered the financial "engine" that powers the agency, and as such, nearly everyone at UTA is a user. However, more specifically:

Finance sales operations and accounting reps are the primary users of client processing, a system which helps the team manage the marketplace that collects revenue from buyers and allocates that money to participants and clients. Agents and the systems they use feed deals into client processing, while FP&A uses deal and payment data for forecasting and other planning activities. Just about everyone is connected here.

Where does AI fit in here?

While a great deal of this effort is focused on building secure and correct systems of record for recording financial transactions vital to UTA's business, we do intend to track and ultimately exploit ongoing innovation in the capabilities of large language models where we think we can create a differentiated capability for UTA. While there are many options, we will likely focus our AI use in three areas:

Acceleration in software development. The ability to use "coding assistants" to generate user interfaces, tests, and other software development artifacts is a domain already rich in products that we and many other companies are using today. While not yet completely automated, these coding assistants greatly accelerate the software development process, and can spot potential errors and opportunities for optimization. Acceleration toward releasing product reduces the impact of cost-of-delay.

Sales optimization and decision support. As we build up detailed financial transaction data in both the departmental CRMs and the deal management component of our design, and assuming we can address security concerns with the current set of hosted large language models, we intend to offer our agents (and possibly clients) capabilities such as detailed comparative deal analysis, alternative deal options, and marketplace analysis to enhance agent dealmaking. These sales optimization AI scenarios will more likely be surfaced in the CRM applications, but the system built here will power those insights.

Contingent revenue tracking. Tracking the numerous bonus, participation, and other contingent terms of entertainment and sports deals requires an unwavering attention to detail and is one of the activities most prone to error. We may be able to take advantage of an LLM, as well as emerging agentic features associated with LLMs to help us here. A software "agent" with rapid and complete access to open contingent payment terms in all UTA deals stored in our deal management component might be able to rapidly research real-world activities to determine if our clients have satisfied the contingent term, and thus create an opportunity for collection.

What are alternative solutions?

Other than sticking with our current solution (Opal), there is no other option. It is not possible to buy an off-the-shelf solution for agency management which covers all the use cases of an agency, the size and scope of UTA. Every large agency has written their own client processing system (sometimes called "trust accounting").